With the upcoming Apple Pay service arriving in the UK for the iPhone 6 in 2015, as well as the pre-existing NFC payments with certain debit cards, the UK is already on its way to embracing wireless payments next year. But if that wasn’t enough, we’ve recently heard that several big high street retailers will also be getting their own payment method using the feature, an app for mobiles known as Zapp.

The service, which allows users to pay for products through their mobile phones, is set to hit big name stores like Asda and Sainsburys, as well as other retailers including House of Fraiser, Clarks, Dune, Shop Direct, Thomas Cook, Siemens and VeriFone.

SEE ALSO: Apple Pay Won’t Hit Europe Until 2015

Zapp has already secured working relationships with large banks like Santander HSBC and Nationwide, meaning that close on 35 million UK shoppers will be able to enjoy wireless payments through their phones when the service is released in 2015.

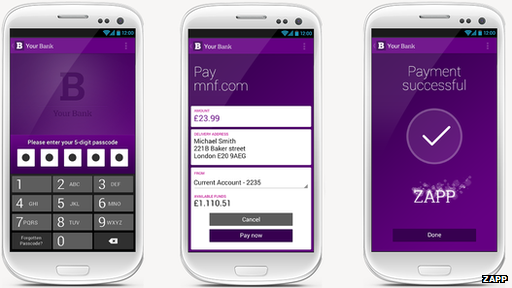

The key feature of Zapp is that it’s not a standalone app – the feature will be incorporated into existing banking apps on an opt-in basis which customers can choose to get on board with or not. Zapp lets you take an item to the till and notify cashiers you want to pay with your phone. To pay, customers simply log into their banking app and transfer funds to the shop’s point of sale by tapping their phone onto an NFC device.

Not only does Zapp work with product purchases, but it also has the ability to pay utility bills with companies such as Anglian Water, Bristol & Wessex Water and Sutton and East Surrey Water. It’s not yet been specified which other utilities are on board, currently only these water providers have been announced.

Zapp’s CEO Peter Keenan spoke to Marketing, an online magazine, detailing the accessibility of the company’s app.

“Unlike Apple Pay or something Google might come out with, Zapp is independent of platform,” Keenan said.

“We work across all platforms and our technology is designed deliberately in that way, it’s what we call open loop. It’s for all customers, all banks and all retailers.”

SEE ALSO: FB Messenger May Soon Include Payments

Jon Rudoe, the digital and technology director at Sainsbury’s also got into contact with marketing detailing the supermarket giant’s dedication to staying up to date with customer needs.

“We know that the way that our customers shop is changing and we’re always looking at new and innovative ways to improve the experience.”

NFC payments are the latest big thing in the smartphone world. Whilst they have been available through contactless card payments on some debit cards, mobile payments in the UK have been slow to be adopted. Hopefully Zapp’s 34 Million potential customers will be able to benefit from the service when it arrives next year.

Release dates haven’t yet been nailed down, but Zapp says that the service will be ready once banking apps are integrated with Zapp’s technology.

Source: Marketing

Via: Engadget