The UK has had access to contactless card payment for ages now, and it’s really, really fun. With a tap of your card and a corresponding beep from the machine, pin entry is made obselete. It’s quick, easy, and it feels really really futuristic. However, a £20 limit has been imposed on the technology since day one, meaning that every transaction you make is capped at that amount.

A welcome relief for users is on the way, with the cap on spending being raised up to £30 by September this year. The average spending spree is, apparently close to that amount, especially for a weekly shop or meal out, according to statistics. However, it’s not going to prevent a day of big spending being looked into by your bank, a happening reported by some who have splashed out at multiple locations.

SEE ALSO: Better Call Saul arrives on Netflix UK one day after US TV

It’s good the banks do perform these checks though, it’s really easy to get scammed with contactless if your card is stolen. However this hasn’t stopped UK customers from getting far more on board with the service over the previous year. official stats from the people over at the UK Cards Association have been on the up across the board.

With the inclusion of contactless pay making it to a huge number of locations, including big city public transport, UK contactless payments reached over £2.3 billion last year, with 319 million transactions across the country using the pin free alternative reported – that’s nigh on 10 payment beeps per second in 2014. These figures have definitely justified the increase in the spending cap.

SEE ALSO: Android Fuelled OBox Console Coming to UK in 2016

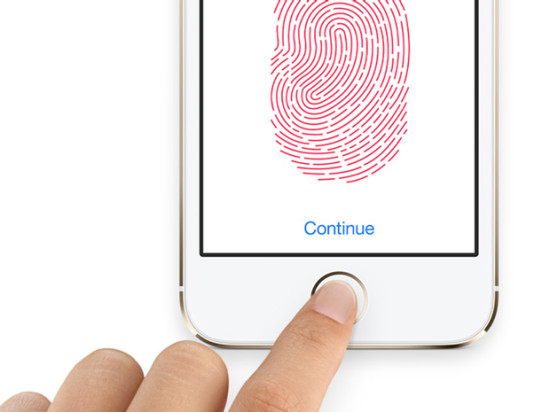

This year is expected to be a huge one for contactless payments globally and in the UK – not only is the celebrated Apple Pay with Apple Watch and iPhone 6 compatibility coming to this country, but also a whole host of secure contactless cards and payment alternatives through mobile phones and other devices are on the way. Most of these payment methods use additional personal security, and may even dispense with cards and pin numbers altogether.

Biometric fingerprint scanners are becoming more portable and more universal in the tech sector, and the sensors have even made it onto cards themselves – we reported last year on Zwipe, a card with its own built in fingerprint sensor, which while not eliminating the card itself will obviously give an additional layer of security on contactless cards. Watch out later in the year for Zwipe, and many more new ways to pay wirelessly.

Via: Engadget

Via: BBC